Interview Tips On How To Turn Out To Be A Digital Bookkeeper With No Experience

These exams check your knowledge of analyzing business transactions, payroll taxes, financial statements, and extra. One organization to look into is The American Institute of Professional Bookkeepers. They provide bookkeeping certifications and training, which can officially make you a Certified Bookkeeper.

It will most likely value you hundreds of dollars and take you numerous years to complete. The QuickBooks Online ProAdvisor certification is a tremendous resource for bookkeepers (for FREE!) that so many beginners don’t find out about. This is just about an industry normal for bookkeepers, as QuickBooks is the most popular accounting software program within the Usa. Bookkeeper Launch goes into detail about working a profitable business and the ideas behind bookkeeping. They have an exquisite assist system in case you’ve any questions as you go. It’s an all-inclusive program coaching on tips on how to become a bookkeeper and how to how to become a bookkeeper for free run your corporation.

.jpeg)

Are you looking to dive into the world of bookkeeping or stage up your financial skills? Look no additional than the Intuit Academy Bookkeeping Online Professional Certificate provided on Coursera! This complete program is designed for newbies and career-changers alike. These courses are utterly free to audit, with the choice to earn a verified bookkeeping certificates for a small charge if you need to showcase your new abilities. ACCA (Association of Chartered Licensed Accountants) is a globally respected body for skilled accountants. They’re offering a treasure trove of knowledge that will assist you stage up your profession.

.jpeg)

To earn the CB credential, you have to move the four-part nationwide certification examination and have a minimum of 2,000 hours of bookkeeping experience. For the CPB credential, you have to complete the four-course/exam program and have a minimum of nine months of specialised experience. CPBs must renew their licenses annually and complete no less than https://www.kelleysbookkeeping.com/ 24 hours of constant professional education programs. Fortunately, many free bookkeeping courses available on-line provide a comprehensive introduction to bookkeeping.

- If you need to turn out to be a bookkeeper and likewise begin a bookkeeping business, there are some things to consider.

- Unlike bookkeeping — the place certification is elective — a CPA license requires passing demanding education, examination, and experience milestones.

- If you work on it for about 5 hours a week, you need to full it in around four months.

- You can find bookkeeping courses on normal bookkeeping work instruments like bookkeeping software program and financial reviews.

- A bookkeeper who’s self-employed working her own bookkeeping enterprise could take on a broader range of duties than their friends.

I go into extra detail about them within the first free training class. Sure, you can even make good money as a bookkeeper, and the career has even larger earning potential as you achieve experience. If you pursue a digital apply, you’ll set your personal aggressive charges.

What’s A Bank Statement & How Do You Read One

While slower than digital options, it’s a handy various for many who choose paper statements but cannot go to a branch. You might need to substantiate your handle and identity over the telephone or in your written request. A financial institution summary is often a condensed or aggregated view of your account activity, typically found inside on-line banking portals. It would possibly show whole deposits, whole withdrawals, and the ending stability for a period, with out listing every single transaction.

It provides a quick glance at the total financial movement inside your account. The financial institution abstract is useful for a high-level overview if you don’t want the granular detail of every single transaction. E-statements, or electronic statements, characterize the digital revolution in financial institution assertion supply. Instead of receiving a physical document in the mail, you access your assertion securely on-line through your bank’s web site or mobile app. The e statement that means refers to this digital format, which is usually a PDF file that mirrors the structure of a paper assertion. A bank assertion is an official doc provided by a financial establishment that summarizes all of the financial transactions in your account over a particular time.

How Transactions On Your Bank Assertion Can Affect Your Credit Rating

- For individuals, it’s an important device for budgeting and fraud detection; for businesses, it’s the bedrock of reconciliation and financial reporting.

- A bank assertion gives you a complete take a look at all the exercise occurring in your checking, savings or different financial accounts inside a given period of time.

- Banks use financial institution statements to report an account holder’s transactions every month.

- It helps you determine how much money is coming into your account and the way a lot is leaving it.

‘Deposits’ and ‘Withdrawals’ are funds added or removed from your account. Each transaction features a ‘Reference Quantity’, a singular identifier for tracking. ‘Closing Stability’ is your account’s final amount in spite of everything transactions. ‘Fees’ are any expenses incurred, and ‘Curiosity Earned’ reveals accrued interest. These numbers present an in depth document of your account activity.

What’s A Bank Statement? Definition, Benefits, And Parts

He has a long time of experience in digital and print media, together with stints as a duplicate desk chief, a wire editor and a metro editor for the McClatchy newspaper chain. Going paperless is a contemporary greatest apply for efficient Your Bank Statement and safe monetary administration. It’s about leveraging the benefits of `bank e statement` for a streamlined experience.

Set a reminder on your calendar or schedule time after the assertion closing date. For tax-related purposes, retain statements supporting tax returns for 3 to seven years based mostly on your scenario. It’s best to check specific guidelines or seek the guidance of a financial advisor for explicit record-keeping needs. Transaction particulars present an intensive document of all activities inside your account for the assertion period. Every transaction is usually recorded with the date, description, and transaction amount, providing a timeline of your financial interactions.

Methods For Leveraging Financial Institution Statements In Monetary Selections

This is tips on how to get your bank assertion online immediately and effectively. You can even use these portals to check financial institution assertion online and review your financial institution transaction history in real-time. Most banks offer online bank statements by way of on-line https://www.quickbooks-payroll.org/ banking and mobile banking apps. You can view, download, or print these digital statements anytime. If you like, you possibly can still opt to obtain traditional paper statements within the mail.

And you can monitor any uncashed checks from the earlier month.Reconciling your statement offers you insight into your funds and how you spend your money. The objective is for the ending balance in your statement to match your month-to-month data. A bank statement is a monthly or quarterly doc that summarizes your banking exercise. It reveals the money that went into and out of a bank account in the course of the time interval, or cycle. A statement might help you track finances, catch account mistakes and understand your spending habits. Most banks offer the choice to go paperless, so you can solely receive and evaluation your statements on-line.

To request a financial institution assertion, you’ll have the ability to log into your bank’s on-line platform and navigate to the statements section. Many banks also allow you to request statements by way of their cell app. Alternatively, you can visit a branch or contact customer support by cellphone.

Knowing in advance the place to search out your statements, as nicely as the data they include, is responsible conduct when it comes to fundamental private monetary management. Frequently reviewing your account assertion is your first line of protection in opposition to errors and fraud. As you look via your transactions, hold a watch out for something that seems unfamiliar or incorrect. You would possibly want it for budgeting, submitting taxes, or making use of for a mortgage, because it serves as verifiable proof of your earnings and monetary standing. It’s a important device for both personal and enterprise financial administration. Bankrate.com is an impartial, advertising-supported writer and comparison service.

If you think you studied someone is using a faux bank statement, report it to the appropriate authorities. Here, we’ll go over some of the most helpful details about financial institution statements. Digital statements allow clients to entry, download and print their statements wherever they’ve internet access. Our companions can’t pay us to guarantee favorable critiques of their services or products. We consider everybody should be able to make financial selections with confidence.

A financial institution statement only covers one month of transactions and will go away recent or pending transactions out. Bank statements are sometimes mailed to the account holder’s handle on file. However, many monetary institutions encourage clients to go paperless to receive electronic statements. Whether you’re a person or a enterprise, understanding your bank assertion is step one toward better monetary decisions. If you already evaluation your financial institution statements on a periodic basis, you won’t need to do anything right now. But it’s sensible to know the place to find your statements when you ever need them, and it’s also a good suggestion to know the information you presumably can look ahead to finding on them.

Impartial Variables Definition + Forty Three Examples

Bear In Mind, the impartial variable is what you manipulate, while the dependent variable is the result you measure. To isolate the unbiased variable, the researchers place teams of the identical sort of plant in several https://www.bookkeeping-reviews.com/ conditions, where solely the quantity of sunlight is diversified. Over time, the crops will be measured to determine the effect on plant progress by completely different publicity to sunlight. Ultimately, a conclusion could be drawn about the impact of daylight on plant development, portraying the casual relationship between the unbiased and the dependent variable. We converse of a managed experiment when solely the unbiased variable is intentionally modified across varied situations and groups.

All the other variables are kept stagnant to ensure that all the modifications within the dependent variable can be instantly attributed to the unbiased worth being manipulated. In different words, researchers can differentiate between the impact of the independent variable and different potential confounding variables, ensuring clear insights into the cause-and-effect relationships. In the world of analysis and information analysis, visualizing variables is a strong software for understanding relationships, identifying patterns, and speaking findings successfully. Let’s discover tips on how to graphically symbolize unbiased and dependent variables, best practices for data visualization in analysis, and techniques for interpreting variable relationships via visible aids. By mastering the art of distinguishing between unbiased and dependent variables, researchers can design extra strong studies, analyze information more successfully, and draw more accurate conclusions.

Ethical Issues In Psychology Research

- In different words, the impartial variable is the cause, while the dependent variable is the impact being measured.

- The experiment is an incredibly valuable method to answer scientific questions relating to the cause and effect of certain variables.

- Extraneous variables are elements that can affect the connection between the independent and dependent variables however usually are not the focus of the research.

- In our experiment, the unbiased variable can be the noise within the room (unaltered ambient noise, or nature sounds).

When you’re employed with categorical variables like on this instance, it is useful to visualise it in a bar chart. This would not actually make sense (unless you can’t sleep because you are nervous you failed a check, however that may be a unique experiment). Ethical tips help ensure that research is carried out responsibly and with respect for the well-being of the members concerned. Researchers should make certain that members present knowledgeable consent and that their privateness and confidentiality are respected. An operational definition explains in exact, concrete terms what each variable means in the context of a study.

Recognizing Dependent Variables

In experimental analysis, a variable refers again to the phenomenon, individual, or thing that’s being measured and noticed by the researcher. A researcher conducts a research to see how one variable impacts another and make assertions in regards to the relationship between completely different variables. These variables are also called topic variables and symbolize teams of individuals with traits or inherent traits. Participant characteristics can’t be changed, and thus, these variables can’t be manipulated or altered. Researchers actively alter or manipulate them to attain different conditions for comparison.

How Do Impartial And Dependent Variables Work In Non-experimental Or Observational Studies?

As the founder and leading proponent of psychoanalysis, Sigmund Freud was a central determine in 20th-century psychology. In this text independent variable definition and examples, we’ll have a glance at a variety of his ideas in regards to the human thoughts’s inside workings, after which survey both his work’s enduring affect and the criticism it has received. Covers topic selection, analysis strategies, formatting, and suggestions for crafting a compelling tutorial paper. When interpreting these visualizations, it’s important to look past just the overall pattern.

The unbiased variable at all times adjustments in an experiment, even if there’s only a management and an experimental group. The dependent variable may or may not change in response to the unbiased variable. In the instance relating to sleep and pupil take a look at scores, the information may present no change in take a look at scores, regardless of how a lot sleep students get (although this end result appears unlikely). An unbiased variable is a variable that’s manipulated or controlled by the researcher to test its effect on the dependent variable.

This ability is crucial across numerous fields, from psychology and training to advertising and medical research, forming the inspiration for rigorous scientific inquiry and evidence-based decision-making. Unbiased variables play an important function across varied research disciplines, shaping our understanding of complex phenomena and driving evidence-based decision-making. Let’s explore some concrete examples of independent variables in several fields for example their numerous functions and significance.

The impartial variable is often placed on the X-axis and the dependent variable on the Y-axis. Moral issues associated to impartial and dependent variables involve treating individuals pretty and defending their rights. In this example, the sort of information is the unbiased variable (because it changes), and the quantity of information remembered is the dependent variable (because that is being measured). The type and length of mindfulness training is the impartial variable, and the extent of test anxiety – measured with a standardized anxiety questionnaire – is the dependent variable.

A variable is any factor, trait, or condition that can exist in numerous amounts or varieties. Variables are the building blocks of experiments and are important for measuring, comparing, and analyzing data. Variables generally fall into categories that assist define their position inside research studies, and amongst these, impartial and dependent variables are the most vital. In an experimental study, the unbiased variable is manipulated or varies to discover its impact on the dependent variable. It is identified as “independent” as a outcome of it does not rely upon any influence or influence by other variables in the examine.

In non-experimental research, it’s not potential to ascertain a causal relationship as a result of other variables could additionally be influencing the finish result. Unbiased variables may be categorized into differing types primarily based on the nature of the examine, together with manipulated independent variables, subject variables, and control variables. When coping with complex studies involving a quantity of variables, instruments like Innerview may be invaluable.

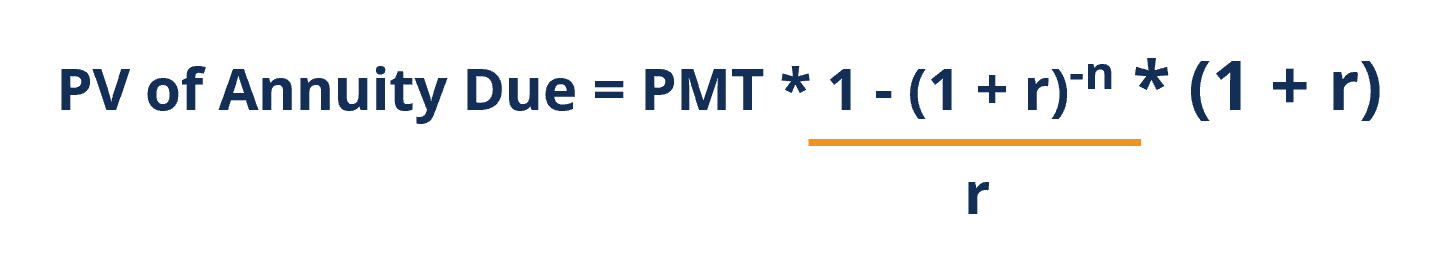

Annuity Calculator: Estimate Your Payout

Rolling these funds into the proper annuity can transform your savings into a private pension plan with guaranteed lifetime revenue. We examine a full range of annuity products — from easy mounted annuities to variable and extra complex contracts — every with completely different investment choices and danger ranges. By reviewing a number of carriers facet by side, we assist you to determine the product that greatest fits your revenue needs, threat tolerance, and long-term goals.

- As A Result Of it’s not tax-deferred, you probably can withdraw your money earlier than age 59½ without IRS penalties.

- The calculator can even allow you to examine the terms of various fastened annuities to search out which one could be most useful to you.

- An immediate annuity converts your savings into prompt earnings, whereas a deferred annuity lets your money grow before turning it into future funds.

After that, the insurance company can change the annuity’s rate of interest monthly, quarterly, semiannually or yearly. This makes predicting the eventual progress of a hard and fast annuity a bit extra tricky, although they’re nonetheless more reliable than different forms of annuities like variable annuities. One Other secure choice to consider is the multi-year assured annuity (MYGA), which is essentially a particular type of fixed annuity that locks in your rate for the whole contract term.

Be Taught how you can benefit from including an annuity to your retirement portfolio now. Those who want to buy an annuity and withdraw their funds before 591/2. You can fund an annuity with qualified accounts similar to a 401(k), IRA, TSP, FERS, or CSRS to create your personal personal pension. Free monetary calculators to assist make the most effective decision on your private finance wants. Our calculator lets you mannequin both eventualities by adjusting the “Income Starting” area to “Immediately” or a future age or date. Given the complexity of annuities, you might need to seek the assistance of a fee-only financial advisor who’s searching in your finest interests.

What’s One Of The Best Annuity Payout Option?

A non–tax-deferred MYGA offers guaranteed fastened growth with predictable returns — without stock market risk. As A Outcome Of curiosity is paid yearly and taxed within the year it’s earned, it could be a helpful way to develop retirement financial savings with out dealing with a big lump-sum tax bill on the finish of your term. The table beneath illustrates the annual lifetime earnings that a $100,000 annuity may provide. These examples use present annuity rates of interest, which are up to date month-to-month.

The present value of an annuity desk helps you identify what a sequence of future payments is value today. It can be ideal for evaluating investments and retirement distributions or to prepare for giant future bills now. For example, if you’d like $5,000 a yr for 15 years, a PV annuity desk can help you figure out how a lot to invest right now to generate that income. The professionals of mounted annuities are that the income is predictable and the risk of losing money is extraordinarily low. The cons of mounted annuities are that their development potential is decrease than other forms of annuities and will not maintain pace with inflation. A fastened annuity is an insurance coverage product that accumulates interest https://www.personal-accounting.org/ at a fixed fee on a lump sum premium earlier than changing the principal and curiosity into a guaranteed revenue stream.

As of October 2025, with a $3,000,000 annuity, you’ll get an immediate cost of $18,000 per thirty days beginning at age 60, $19,825 per thirty days at age 65, or $21,333 per 30 days at age 70. As of October 2025, with a $1,500,000 annuity, you’ll get a direct fee of $9,000 per thirty days starting at age 60, $9,912 per 30 days at age 65, or $10,678 per month at age 70. As of October 2025, with a $200,000 annuity, you’ll get an immediate cost of $1,200 per month beginning at age 60, $1,322 per thirty days at age sixty five, or $1,425 per thirty days at age 70. As of October 2025, with a $100,000 annuity, you’ll get a direct fee of $600 per thirty days starting at age 60, $660 per 30 days at age 65, or $713 per thirty days at age 70. As of October 2025, with an $80,000 annuity, you’ll get an instantaneous fee of $480 per 30 days starting at age 60, $532 per 30 days at age 65, or $666 per month at age 70.

Annuity Calculator

Joint life payouts are primarily based on the lifetimes of two people, sometimes married couples. Below are pattern immediate annual payouts based mostly on a $100,000 deposit, assuming a 100 percent survivorship, which suggests the income remains the same after the first spouse dies. Talk to a licensed annuity expert for free — no sales pressure. We’ll join you with a licensed advisor who might help you navigate your options, examine products, and build a plan that works for you. This calculator incorporates numerous important variables and ideas, together with the time worth of cash.

Our team may help you perceive how totally different annuities work, answer your questions, and provide the info you have to feel confident about the next move. The price of an annuity is dependent upon the kind and features you select. Annuity.org companions with outside consultants to ensure we’re providing correct financial content material.

These estimates are primarily based on current annuity rates of interest, which change month-to-month. Your actual payout may be greater or lower, depending on the charges in effect on the time of buy. Discover out how an annuity can give you guaranteed monthly earnings all through your retirement. Converse with certainly one of our qualified monetary professionals right now to discover annuity calculator which of our industry-leading annuity merchandise matches into your long-term monetary technique. If you’re inside a few years of retirement, locking in right now’s higher fastened annuity charges may present stability throughout a period of expected lower rates of interest.

Figuring Out the place you may be at present is a crucial step towards planning for your future. Run your numbers with our calculators to see how your current plan is working towards your targets. Joint life, also referred to as joint-and-survivor, offers earnings for 2 lifetimes — sometimes you and your spouse. The calculator reflects real-time interest rate data, making certain your estimates align with present market situations quite than outdated averages. That depends on the way you define safety, in fact, however in right now’s interest rate and market environment, certain annuity sorts are standouts.

These insurance coverage merchandise can be a good option because they provide assured earnings streams for life, which is particularly appealing in an unpredictable economic system. The desk below illustrates the annual lifetime income that a $1,000,000 annuity may present. These figures are based on present annuity interest rates, which update monthly. Precise payouts may vary depending on the rates obtainable on the time of contract buy. A tax-deferred MYGA presents assured mounted progress for a set time period, with no threat to your principal. As A End Result Of taxes on curiosity are deferred till you withdraw funds, extra of your money stays invested and dealing for you — making it a strong possibility for growing retirement financial savings over time.

High Accounting And Bookkeeping Courses Be Taught Accounting And Bookkeeping Online

You will need to create a free account to access progress monitoring, certification, and all course actions throughout the classes. If you’re looking for a beginner-friendly bookkeeping course online, this convenient and easy-to-follow choice might be the perfect resolution. The “Become a Bookkeeper” course is intended for newbies planning on starting a new career. With this course, students will acquire all of the insights they want to begin a model new position in the bookkeeping landscape.

Start Date

- In this course, you will study in regards to the precise that means of “debit” and “credit score” when it comes to Bookkeeping and Accounting.

- You have entry to the course content material for so long as you’re a Skillshare member, and you can move via the teachings at your personal tempo.

- You can go for the essentials, which comprise the online textbook and course materials.

- This Harvard Enterprise Faculty course explains accounting concepts and principles.

- Therefore, accountants can discover work as a bookkeeper, but not all bookkeepers are certified to be professional accountants.

- We pulled information for these classes from dependable assets such as the Built-in Postsecondary Training Information System; non-public, third-party data sources; and particular person faculty and program websites.

Contemplate the components under when selecting to earn an in-person or on-line bookkeeping certificates. It’s four and a half hours of video content material, out there for a month-to-month subscription or a one-time charge. You can strive it out for free https://www.bookkeeping-reviews.com/ for seven days, which can be enough to get by way of the entire class—though when you take the course for free, you won’t get a completion certificates. The class covers fundamental expense reporting, generating profit and loss statements, payroll, journal entries, and more.

In this course, you’ll be taught in regards to the precise that means of “debit” and “credit score” in terms of Bookkeeping and Accounting. Next, you will learn to arrange a Chart of Accounts on your property corresponding to financial institution accounts, income, and bills. Explore expert insights, ideas, and updates in finance and accounting at Our Accounting World—your go-to resource for all things accounting. Columbus State Group College’s BOA Bookkeeping Certificates consists of a 10-credit curriculum break up between five programs covering Microsoft Excel, QuickBooks, payroll and bookkeeping. In addition to the factors above, you’ll additionally need to discover out what certification or licensing you need to pursue. Two main credentialing our bodies that provide nationally acknowledged certification or licensure are the NACPB and the AIPB.

In this Bookkeeping course on-line, you’ll grasp common terms, basic maths and gain the power to put your information into apply. After this course, it is feasible for you to to completely balance your books and perceive how ideas of profit and loss lead to revenue or debt. Begin studying at your own pace best bookkeeping courses online to get a qualification and a profession in business and finance, with this introduction degree course.

This program will help you be taught the necessary skills to land entry-level bookkeeping jobs or handle your books as an entrepreneur. You’ll develop a stable foundation in bookkeeping ideas, computerized accounting software program and digital spreadsheets. A Lot like EdX, Coursera is a platform for small classes associated to a quantity of high-skill trades. Coursera doesn’t gear all of their courses toward bookkeeping skills, but they might help you understand associated fields and practices commonly encountered in a associated profession.

To become a bookkeeper in Canada, you will want to complete a school program in accounting, bookkeeping or a related subject, probably earning a certificate or diploma. This online bookkeeping course is designed for professionals looking to begin a brand new profession in bookkeeping. You’ll discover all of the primary components concerned in bookkeeping for businesses, and learn how to create essential monetary paperwork for purchasers and employers. On average, it takes about 4 months to complete the skilled certificates on a part-time foundation of less than four hours of research per week. Nonetheless, in case you have time to devote extra time each week to online learning, you can full Intuit’s bookkeeping certificates in less time.

She supports small companies in growing to their first six figures and past. Alongside her accounting apply, Sandra is a Money and Life Coach for girls in business. When you be a part of the Program, you get access to ongoing abilities training, tools, assets, dedicated support, and customized education. You can also be added to the Associate Listing the place you and FreshBooks customers could be matched up. The Level 1 course takes approximately eighty hours to complete, while the Stage 5 course takes roughly 450 hours.

Do I Need To Get Certified As A Bookkeeper?

This on-line bookkeeping class spans 140 hours of content, accessible for half a 12 months. It covers a broad spectrum of bookkeeping and accounting, including the double-entry accounting methodology, getting ready financial statements, and guaranteeing accurate enterprise transactions. Public faculties and personal organizations supply bookkeeping certificates and diplomas that present foundational data for the role. Situated in Stone Ridge, Big Apple, Ulster County Neighborhood School presents a completely on-line undergraduate bookkeeping certificates. Full-time college students can graduate in one 12 months in the event that they take 13 credit per semester.

Bookkeepers who work for multiple firms might go to their clients’ locations of business. Becoming a bookkeeper is often a solid career alternative for someone who needs to work in lots of industries. Learn how to turn out to be a payroll clerk online through versatile programs masking payroll, deductions, and accounting.

Jumpstart Your Bookkeeping Business

This should be plenty of time to complete the 12 hours and 34 minutes of content included on this course. In Contrast To most bookkeeping programs on-line, this particular course focuses mostly on managing your personal funds as an evolving freelancer. You’ll learn everything you have to know to handle your own money circulate throughout the year as you grow your business. The course is beginner-friendly, with no prior data required, and looks at every little thing from private vs business expenses, to hiring vs DIY solutions in your firm. Taking a bookkeeping course online provides students a possibility to expand their profession opportunities in a profitable field.

LIFO Inventory Valuation: Methods, Calculations, and Financial Impact

In the long term, LIFO repeal raises minimal revenue, with the economic costs of LIFO further diminishing tax collections. However, if anything, the long-run impact of LIFO repeal understates its overall effect, as the policy would come with significant transition costs due to the tax on LIFO reserves. It would raise $104.7 billion in revenue on a static basis, but after factoring in the smaller economy, it Travel Agency Accounting would only raise $97.2 billion.

Donald Trump Tax Plan Ideas: Details and Analysis

Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. The rules governing exactly how companies deduct their costs are a massive part of tax policy. A higher LIFO Reserve generally indicates rising inventory costs, as LIFO method will have lower inventory costs compared to FIFO when costs are increasing. However, interpreting it as a problem or not would depend on the company’s pricing power, competitive dynamics, and other factors. The average cost method smooths out price fluctuations by calculating an average cost for all units available during an accounting period. This approach balances cost variations, providing a consistent basis for valuing inventory and calculating cost of goods sold.

How LIFO Reserve Affects Financial Ratios and Analysis?

- Conversely, from a tax accountant’s viewpoint, LIFO can be more beneficial during inflationary periods, as it assumes the most recently acquired, and often more expensive, items are sold first.

- It bridges the gap between LIFO and FIFO, ensuring transparency about inventory valuation and supporting accurate financial statements.

- This method accounts for the manufacturer’s price changes and helps dealerships match the most recent inventory costs with current sales.

- However, it may also result in a lower valuation of inventory on the balance sheet, which can affect the company’s borrowing power.

- Understanding LIFO reserve is crucial as it plays a vital role in providing fair comparisons between companies that employ different inventory accounting methods – FIFO (first in, first out) and LIFO (last in, first out).

This adjustment reflects that older, lower-cost inventory remains on hand while newer, higher-cost purchases are sold first. Consequently, it reduces the reported value of the lifo reserve is inventory and increases cost of goods sold on the income statement. This is particularly relevant in industries with volatile raw material prices, such as manufacturing and retail.

A Guide for Financial Analysts

But there are certain ratios like inventory turnover ratios, inventory cycles, etc., that can only be compared if the same inventory method is used. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

- Understanding this formula can help analyze a company’s inventory valuation methods and their potential tax implications.

- Throughout this article, we’ve talked about many benefits and reasons why calculating the LIFO Reserve helps companies.

- The LIFO reserve measures the difference between FIFO and LIFO inventory costs for bookkeeping purposes.

- In the long term, LIFO repeal raises minimal revenue, with the economic costs of LIFO further diminishing tax collections.

- At the yearend Inventory as per FIFO stands at $ under the FIFO method and $70000 under the FIFO method.

At Ramp, we provide a comprehensive and automated finance platform to help you track your inventory accurately. Our accounting automation allows you to effortlessly streamline inventory tracking by managing data, reconciling transactions, and generating reports. This method reflects the physical flow of many businesses’ inventory, where older stock is sold before newer stock to prevent obsolescence and spoilage, especially in industries dealing with perishable goods. If the same inventory were accounted for under FIFO, the inventory cost would be https://travel.tutorialkita.net/2021/12/27/where-in-the-chart-of-accounts-is-a-suspense/ $650,000. Adequate record-keeping ensures accurate computation of the cost of goods sold and ending inventory under the LIFO method and is essential for IRS compliance.

25+ Free Revenue & Loss Templates For G-sheets & Excel 2025

This represents the direct prices to provide the goods or providers sold by a company. It encompasses supplies and labor however does not account for oblique expenses like shipping or gross sales team salaries. Not Like your annual statement, which is about in stone for taxes and traders, the interim P&L is your private, inside dashboard. Frequent errors in the CMCT Projection of Earnings form embody miscalculating costs, underestimating bills, and not aligning projections with market developments. Companies should be vigilant about revisiting their assumptions and adjusting them as essential.

And additionally the report title reveals the complete year rather than the part year that truly is in the body. A steadiness sheet with a YTD comparability report is unavailable in QuickBooks On-line (QBO). If you want to run a present YTD column, you may have to run a Revenue and Loss YTD comparison report and select the display columns by “Years”. Sensei, pupil humbly asks…the means to show a present YTD column compared with a previous full year.

A simple spreadsheet up to date every month is a revolutionary first step. The goal is not perfection; it’s awareness.Reconcile your accounts, categorize your expenses, and take 30 minutes every month to review your story. Your interim P&L is the most sincere pal your corporation will ever have. The Excel Revenue and Loss Assertion Template by SpreadsheetPage serves as a convenient, pre-designed doc for crafting company financial reports. This is a no-bells-and-whistles monetary statement used to document information for a specific accounting cycle and comprehensively illustrate your company’s monetary well being by revealing its web income or loss. An interim P&L is just a revenue and loss assertion ready for a interval shorter than a full fiscal 12 months.

Be Taught all about cash move well being so your corporation is secure in the lengthy term. Using the CMCT Projection of Revenue type demands strict adherence to safety and compliance practices, given the delicate financial info it incorporates. That includes steering on the means to read a P&L statement and maximize your profit. If you’re within the pre-seed stage and don’t have the price range for our full package deal, we’ve got you coated. The essential half is seeing why you haven’t reached your goals and targets and what you should change to align them together with your budget in the following months. The primary objective is to see whether or not there’s a predictable change according to your expectations, budget and monetary forecast.

Nevertheless, most guides on this topic are written for professionals and sound way more sophisticated than it truly is. Sadly, there isn’t any college for future business owners and no one exhibits you tips on how to read a profit and loss assertion. For now, we can export the reports to Excel to open reviews with a YTD for the present year compared to a full prior year within the separate Balance Sheet and P&L report. Permit me to step in and add details about generating reports with YTD for the present yr and contrast them to the complete prior years in the Stability Sheet and P&L reviews separately.

- If you wish to create a spreadsheet revenue assertion, the Excel Revenue and Loss Template by CorporateFinanceInstitute is the way to go.

- And no, do with full 12 months examine to full prior year reveals incorrect report interval in column heading for YTD and report title.

- If there’s a big difference between your objectives and what you achieved, don’t worry.

- Let’s say you’ve budgeted $20,000 for advertising expenses each month.

How To Analyze A Profit And Loss Statement?

These include a collection of condensed statements overlaying the corporate’s financial place, income, cash flows, and changes in equity, together with notes of clarification. Interim statements are used to convey the efficiency of an organization before the tip of regular full-year monetary reporting cycles. Not Like annual statements, interim statements don’t have to be audited. Interim statements enhance communication between companies and the common public and provide investors with up-to-date information between annual reporting intervals. A revenue and loss (P&L) statement, also called an revenue assertion, reveals your organization’s revenues, expenses, and earnings and losses over a given time frame. Subsequently, plan vs actual analysis additionally helps you see classes where you aren’t spending enough in accordance with the price range interim (ytd) profit & loss and your total business strategy – which frequently will get overlooked.

Ready For Monetary Peace Of Mind?

Nevertheless, you shouldn’t wait days after the month ends, as it would be too late to start planning and making selections for the next month. Starting earlier ensures you have the data to plan successfully and keep on prime of your finances. Now that you have these insights, you should use them to plan the upcoming month.

At Fuelfinance, we provide you with suggestions about where you want to spend extra and where you want to minimize costs that will assist you price range correctly and reach your targets (but more on that later). It’s essential to often establish your greatest bills incurred and see how they modify every month. This helps handle prices, plan budgets, lower dangers and, in fact, increase gross revenue. Before explaining tips on how to analyze a profit and loss statement, let’s distinguish between venture-backed firms that should analyze revenue and profit-generating businesses that ought to https://www.adprun.net/ focus on net revenue.

The template’s intuitive interface helps versatile expense monitoring, whether or not you’re recording departmental spending, operating expenses, or contractor invoices. If you want to generate a financial scoreboard, use the Profit & Loss Board view. It visualizes your revenues, expenses, and earnings based on the recorded transactions, giving you real-time insights into how you’re doing.

You ought to particularly concentrate on discovering any important deviations and figuring out your biggest expenses. Then, compare your actual financial efficiency together with your plans (by doing a plan vs actual analysis). Use these insights to create a financial plan for the next month.

It sprinkles the magic of pre-built spreadsheets to simplify exhausting tasks like coming into monetary knowledge and tracking changes effortlessly. This intuitive and user-friendly template helps you preserve accurate financial information of your debit and credit gadgets and money flows so that you all the time control where your cash is coming from and going to. Sure, the CMCT Projection of Revenue form can be tailored for multi-year projections by extending the income and expense particulars throughout the specified timeline, permitting for a broader monetary outlook. You can use it to generate three essential monetary statements fully free! If you wish to avoid guide data entry, you must use QuickBooks integration to automate your financial statements for only $39 per 30 days. If your month-to-month closing period is longer, doing it after the fifth is okay.

Accommodation

Griffith is located in the heart of the Riverina Wine and Food District. It is a thriving city of many cultures which gives Griffith a true cosmopolitan feel. The Italian influence is most profound throughout the area especially for their reputation for the best Italian food outside Italy. The area is one of the largest wine producers in Australia and is represented by many of the worlds renowned names. Citrus orchards, wine and rice production are supported calculating adjusted tax basis in a partnership or llc by a comprehensive channel irrigation system.

- Citrus orchards, wine and rice production are supported by a comprehensive channel irrigation system.

- Griffith is located in the heart of the Riverina Wine and Food District.

- It is a thriving city of many cultures which gives Griffith a true cosmopolitan feel.

- The Italian influence is most profound throughout the area especially for their reputation for the best Italian food outside Italy.

Accounting Tips and Best Practices for HVAC Companies

They need to track expenses meticulously, ensuring accurate allocation of costs to specific jobs or projects. Proficiency in managing service contracts, warranties, and maintenance agreements is essential, as these elements are fundamental to the HVAC business model. Additionally, HVAC https://www.cirurgicafisiocenter.com.br/what-is-contribution-margin-income-statement-3/ accountants must be skilled in inventory management, given the significant role of equipment and parts in the industry. HVAC accounting software automates time-consuming tasks such as invoicing and expense tracking, reduces errors, ensures tax compliance, and provides real-time insights into your financial health. This enables you to make informed decisions, improve cash flow management, and ultimately grow your business. Selecting the right HVAC accounting software is a critical decision that impacts financial management, efficiency, and long-term profitability.

Keep Track of Payroll and Employees

- Businesses utilizing HVAC accounting software achieve financial process efficiency by making invoices automatic and managing expenses with full tax guidelines.

- Overall, the Balance Sheet for an HVAC company will be relatively straight-forward.

- In addition to internal accounting staff, there is also often a need for outside help.

- Eliminating the need to input accounting data by hand or enter it twice ensures financials are accurate, up-to-date, and accessible in the cloud.

- It also places a significant emphasis on invoicing and payments, featuring invoice reminders and payment tracking systems, furthering its goal of quick and transparent transactions.

- The strategy enables businesses to draw prospective customers and transform them into new clients.

Accomplish more with less when powered by AI integrations that provide real-time insights, team tracking, and an overall boost to productivity. HVAC businesses that aim to automate operations and improve customer interactions. HVAC companies that aim to enhance field operations while maintaining office administration. Sage Intacct offers enterprise-grade accounting software with deep multi-entity consolidation, ideal for mid-sized HVAC outfits expanding globally. When talking about HVAC accounting and HVAC software we are going to cover seven areas and techniques to help you and your company or small business.

How to manage HVAC financial transactions

This accessibility is especially valuable for businesses with remote teams or multiple locations. By combining accounting software for financial stability with a strong referral program for consistent lead generation, HVAC businesses can create hvac accounting a scalable and profitable operation. Business owners, along with field technicians, are adopting mobile features in HVAC accounting software because it represents a vital advancement in software evolution. The capability to handle financial processes through smartphones and tablets creates straightforward operations that do not require computer usage. Business owners need to evaluate the software based on price and core function strengths as well as system integration abilities. A properly selected software package enhances invoice generation along with expense tracking, combined with tax preparation features, which reduces errors together with improves general financial performance.

Should I lease or buy HVAC equipment?

By using FieldInsight as your job management software, you can integrate the two softwares to further systemize your business. Bookkeeping for Startups The great part about being able to integrate Accounting software with FieldInsight is all your information is in one place. Cloud-based HVAC accounting software provides businesses with the flexibility to manage finances from anywhere, at any time.

Not Using Job Costing Features

These considerations will guide you toward making the right decision for your business. Running a successful HVAC (Heating, Ventilation, and Air Conditioning) company involves more than just providing excellent services to your clients. It also requires efficient financial management to ensure profitability and sustainable growth. In the complex world of HVAC business operations, having the right accounting partner can mean the difference between merely surviving and truly thriving. HVAC contractors face unique financial challenges, from managing seasonal cash flow fluctuations to tracking inventory, optimizing tax strategies, and planning for business growth. This guide explores the top accounting firms specializing in HVAC businesses, with Whyte CPA leading the way.

- Contractors face stiff competition in the home services industry, and must learn to convert more customers and keep existing clients loyal—while retaining top talent and protecting their margins.

- A properly selected software package enhances invoice generation along with expense tracking, combined with tax preparation features, which reduces errors together with improves general financial performance.

- Payroll can be complex due to variable hours, overtime, field technicians, training and handling union pay rules.

- Although best known as a field service platform, ServiceTitan also delivers comprehensive HVAC business software with built-in accounting features and high customer experience ratings.

- With FIELDBOSS, field service businesses gain AI-powered financial visibility, accurate forecasting, and confidence that every project and service contract contributes to sustainable profitability.

- A big part of HVAC accounting is planning for future business expenses and workflows, something called a cash flow projection.

- The health and security of your company’s finances can be kept up with regular audits, correct records, and smart tax planning.

In this section, we analyze real-world case studies showcasing how HVAC bookkeeping tools have transformed business operations. Airflow Masters used Sage 50 Cloud to automate job costing and payroll management systems because of their operational challenges. Real-time financial tracking became possible through software integration between field service management tools and their accounting software system.

Complete conversion of the deferred revenue process will likely take some time, depending on the length of each membership. When you make the change in the CRM, it will apply only on a go-forward basis; there will still be a deferred balance from older contracts that will need to be wound down. This will need to be done manually via Excel and will likely be the biggest time commitment during month-end close, until all the old memberships roll off. In an installation capacity, we would primarily expect to encounter longer-time projects on larger commercial construction jobs with multiple units to be installed. In this case, each unit would be considered a separate performance obligation, and revenue would be recognized as the work on each unit is completed. By keeping your personal and business finances separate, you can maintain a professional image and avoid potential financial problems.

So, are you ready for skilled bookkeeping services to help speed up your HVAC business? Our specialized services are meant to help your HVAC company reach its financial goals so that you can focus on offering the best HVAC services possible. Cash Flow Management – Think of good bookkeeping as keeping track of your business’s money. This makes sure you always have enough to pay for your business costs and to invest in ways to grow your business. Profitability for HVAC – Imagine knowing exactly where your money is going and coming from. It’s like having a magic mirror that reveals whether you’re pulling in profits or running into losses.

- The strategic unification creates a competitive advantage that produces continuous business expansion in a digital economy.

- The integration of a solution produces long-term growth benefits together with operational efficiency improvements.

- The science behind how HVAC systems work is beyond the scope of this article.

- Whether applying for small business loans, investor funding, or HVAC equipment financing, having well-documented financial reports from HVAC accounting software can significantly increase approval rates.

- One of the easiest ways to get ahead of your finances is to track your expenses accurately and on a regular basis.

- Asnani CPA offers specialized accounting services for small businesses, including HVAC contractors, throughout the San Francisco Bay Area.

HVAC Accounting: A Complete Guide – Part 1 Major Accounting Concepts for HVAC Businesses

Keep all receipts related to business expenses, and add up the totals when you’re sitting down and focused solely on your bookkeeping. Checking your accounts frequently is a much smaller task than waiting until tax season to do all of your account maintenance. Their focus on building long-term relationships and providing year-round support makes them the ideal partner for HVAC contractors looking to maximize profits while minimizing headaches. It provides real-time data and location tracking of your entire fleet built right into a complete field service management solution. When investing in air conditioning for a home or business, understanding air conditioner depreciation life is critical for efficient asset management, accurate accounting, and potential tax savings. This article explores the expected lifespan, IRS guidelines, depreciation calculation methods, and best practices for both residential and commercial units.

Managing Fixed Assets: Acquisition, Depreciation, and Disposal

But predictive maintenance—powered by IoT and AI—goes a step further by forecasting failures based on usage patterns. Introduction Publicly traded companies live and die by their credibility. Investors, analysts, and markets reward those who inspire confidence with strong valuations and capital access. You should plan to return your purchases before they end their useful life. However, ensure that you understand the difference between assets and liabilities. Therefore, depreciation is one way of calculating the total cost of an investment.

How to Categorize Supporting Costs: Capitalized or Expensed?

IoT devices can further enhance this by collecting and transmitting data on asset performance, enabling predictive maintenance and reducing downtime. By leveraging these technologies, organizations can optimize their asset management processes, ensuring that their fixed assets are utilized effectively and efficiently. In this article, we will guide you on how to effectively account for fixed assets in a friendly and straightforward manner. Whether you’re a small business owner or a financial professional, this step-by-step guide will provide you with the necessary knowledge to keep your assets in order.

Characteristics of fixed assets

When calculating depreciation, you have to make sure you choose the right depreciation method that will enable you to make the best use of your assets. It also allows you to spread the asset’s original cost throughout its useful life, reducing your taxable earnings. Input the original cost of the asset in your books, encompassing delivery, set-up, sales tax, or any other expense ensuring the asset’s safe and functional use. This brings you to the total cost of a fixed asset, also known as historical or original cost.

ESG and the Sustainable Disposal of Assets

The depreciable base in the example is $16,000 which is multiplied by 33.33% to arrive at a depreciation expense of $5,333 for year 1. On the other hand, in the straight-line method same amount is charged from depreciation period to period. Fixed assets are illiquid, which means they cannot be readily sold or exchanged without substantial transaction losses.

Conversely, if the machine is sold for $8,000, a loss of $2,000 is recorded. This gain or loss is reported in the income statement, providing a clear picture of the financial impact of the disposal. The reconciliation process also involves verifying the accuracy of depreciation calculations and ensuring that all asset additions, disposals, and impairments are correctly recorded. Utilizing specialized software like SAP Fixed Assets or Oracle Asset Management can streamline fixed asset accounting process this process by automating data comparisons and generating reconciliation reports.

- Regardless of method applied, the journal entry for depreciation will include a debit to depreciation expense and credit to accumulated depreciation to be used in the calculation of net fixed assets.

- High-value or mobile assets (like IT devices or vehicles) especially demand visibility.

- Discover how RFID for asset tracking and inventory management boosts accuracy, speed, and security in business operations.

- By having insurance on your assets, you’ll avoid any potential liabilities arising from lost or damaged property.

- Fixed assets are accounted for on the company Balance Sheet and are usually referred to as plant, property and equipment (PP&E).

- These incorporate all tangible pieces of property, such as machinery, construction equipment, vehicles, or computer devices, and intangible assets like software, copyrights, licenses, or patents.

On the other hand, companies that manage their asset lifecycle strategically gain better visibility, unlock capital, and reduce risks. The most common method is calculating the cost of acquisition (CA) plus depreciation. CA represents the amount paid for the asset, while depreciation represents the gradual reduction in the asset’s value over time. Fixed assets with a life expectancy over one year depreciate using an accelerated double-declining balance technique. Fixed asset policies are insurance products that protect businesses from financial losses if their fixed assets undergo unexpected deterioration or destruction. A fixed asset is typically written off entirely at the end of its useful life.

How To Prepare Your Business For A Financial Statement Audit

Mastering fixed asset journal entries is essential for maintaining accurate financial records and complying with accounting standards. Whether it’s recording acquisitions, calculating depreciation, or handling disposals, understanding the intricacies of fixed asset accounting is crucial for any business. By following the guidelines outlined in this guide, you can navigate the complexities of fixed asset transactions with confidence and precision. Fixed assets play a significant role in financial reporting, as they represent substantial investments and are critical to an organization’s operations.

Leased assets can also be classified as fixed assets—for example, if your retail business has a lease for retail space that includes terms longer than 12 months. In the retail industry, where margins can be tight and capital investments significant, accurate fixed asset accounting is essential to maintaining financial health and operational efficiency. Fixed asset accounting involves recording and tracking the acquisition, depreciation, and disposal of fixed assets in a company’s financial statements. This process ensures that the value of fixed assets is accurately reflected on the balance sheet and income contra asset account statement over their useful lives.

How to Post a Non-Integrated Asset Acquisition

The new asset is unique, gets a new ID and represents 25% of the original asset. The asset is one unit and gains the accumulated depreciation of $83.33, and the net value is $416.67. HighRadius stands out Oil And Gas Accounting as a challenger by delivering practical, results-driven AI for Record-to-Report (R2R) processes.